In this video in collaboration with Arab Bank (Switzerland) Lebanon S.A.L. I will share the most common red flags for Terrorism Financing.

#aml #compliance #terrorism #terroristfinancing #inanutshellbymj #marijosamneh

#inanutshellbymj #marijosamneh #compliance #aml #sanctions #syria

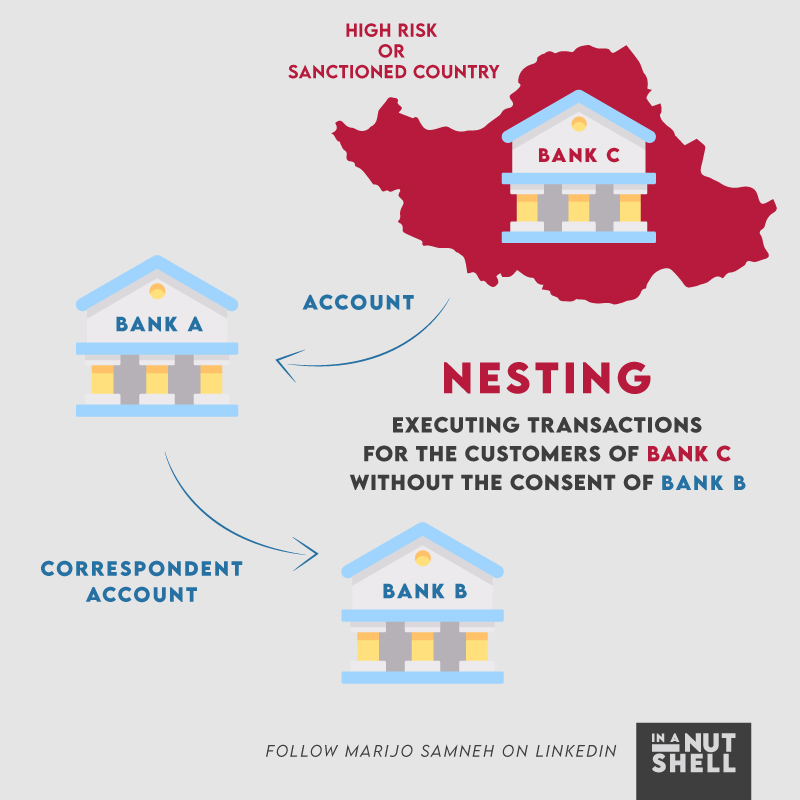

Nesting – In a Nutshell

Nesting is the bank’s misuse of its relationship with correspondent banks, by carrying out transactions for other banks’ customers, when the other bank could be located in a country that is subject to sanctions and embargoes, or rated as a high risk country. Therefore, main correspondent banks around the world avoid dealing with such banks.

#aml #amlcompliance #compliance #marijosamneh #inanutsehllbymj

#fraud #compliance #aml