#crypto #cryptocurrency #aml #compliance #inanutshellbymj #marijosamneh #corporatecode

مؤشرات تمويل الإرهاب

In this video in collaboration with Arab Bank (Switzerland) Lebanon S.A.L. I will share the most common red flags for Terrorism Financing.

#aml #compliance #terrorism #terroristfinancing #inanutshellbymj #marijosamneh

Sanctions on Syria – In a Nutshell

#inanutshellbymj #marijosamneh #compliance #aml #sanctions #syria

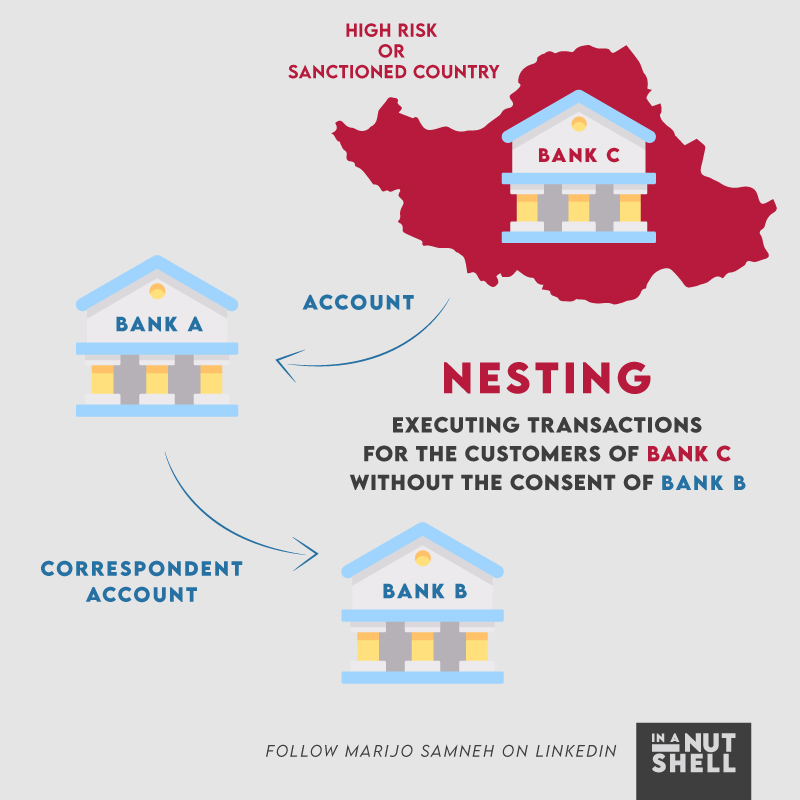

Nesting – In a Nutshell

Nesting – In a Nutshell

Nesting is the bank’s misuse of its relationship with correspondent banks, by carrying out transactions for other banks’ customers, when the other bank could be located in a country that is subject to sanctions and embargoes, or rated as a high risk country. Therefore, main correspondent banks around the world avoid dealing with such banks.

#aml #amlcompliance #compliance #marijosamneh #inanutsehllbymj

Dormant or Frozen Account

Accounts are considered frozen or dormant when no transactions are carried out for a certain period of time.

After this period, which are determined by the regulator or the institution’s internal policies, the account must be considered frozen or dormant.

Dormancy periods are usually different, depending on the type of account; current accounts, deposit accounts etc.

Risks from dormant accounts are high, due to the possibility of internal fraud, rather than money laundering.

There is the possibility that one of the bank’s employees could be aware of the account, and see an opportunity to take advantage of the dormant account through a fraud scheme.

#compliance #fraud #inanutshellbymj #marijosamneh #amlcompliance

Fraud

#fraud #compliance #aml

Trade-Based Money Laundering

This video, in collaboration with Arab Bank (Switzerland) Lebanon S.A.L. summarizes the concept of Trade-Based Money Laundering and shows its most common techniques.

#compliance #aml #amlcompliance #marijosamneh #inanutshellbymj

Cross Border – New Collaboration

I am proud to announce my collaboration with Indigita SA a leading Swiss regulatory technology company, that is using the power of digitization to help Financial Institutions apply the relevant rules and provide them with guidance.

Ingigita’s e-Learning solutions is an easy tool containing cross border and compliance training.

#inanutshellbymj #collaboration #marijosamneh #compliance #crossborder

September 26 is Compliance Officers’ Day

Therefore it is the line of defense protecting both Customers and the Institution.