The principal responsibility for a bank’s Money Laundering risk management lies with the board of directors.

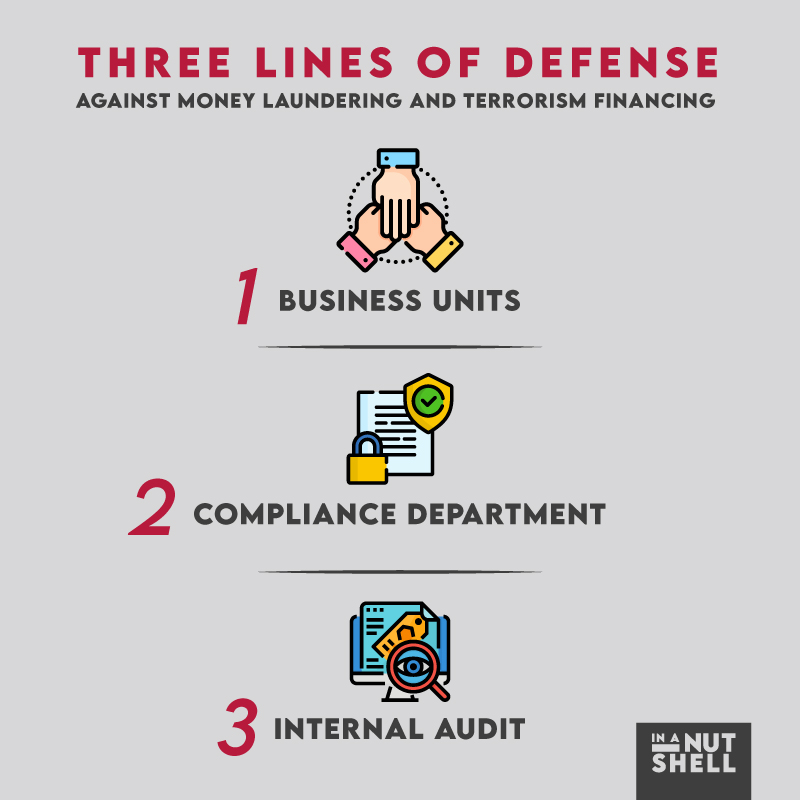

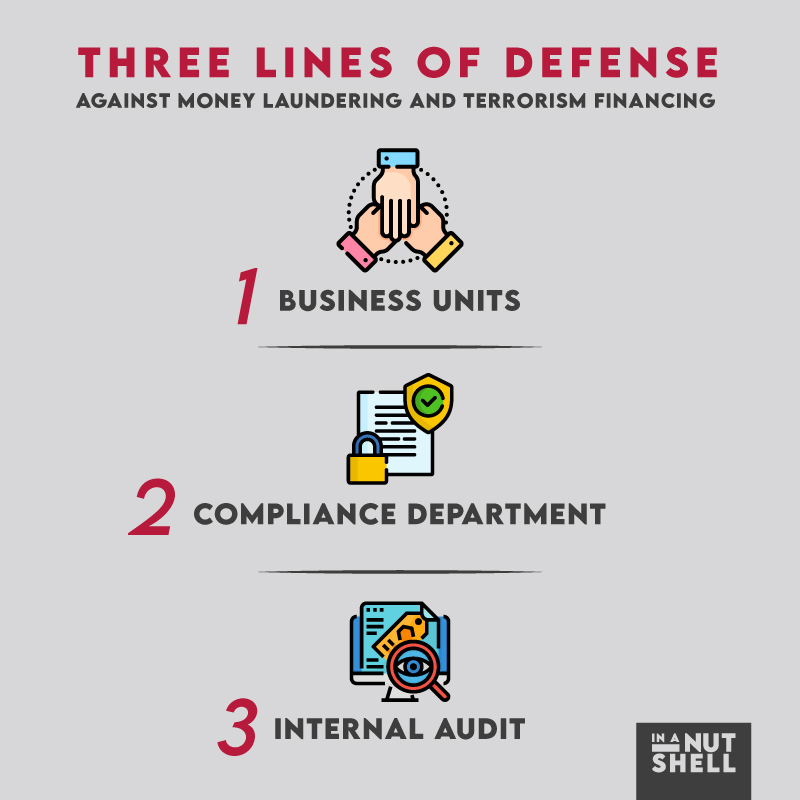

It is responsible for defining and overseeing a bank’s Anti Money Laundering/Combatting Financing Terrorism policy and allocating operational responsibilities and resources under the “three lines of defense”:

-The “first line of defense” lies with a bank’s business units, such as private banking or asset management divisions. These units are responsible for identifying, assessing and controlling ML/TF through the use of customer due diligence practices.

-The “second line of defense” refers to the compliance department, as well as human resources and technology. These entities should be independent of business units, give independent advice to management and act as main contact point for the relevant authorities.

-The “third line of defense” refers to the independent internal audit function.

TO KEEP IT SIMPLE: BUSINESS PEOPLE WHO ONLY CARE ABOUT GROWING THEIR PORTFOLIO, BE AWARE THAT YOU ARE FIRST IN LINE. IN CASE OF ANY DIFFERENT WITH YOUR CLIENT, YOUR JOB AND CAREER WILL BE ON THE LINE.

SO NEVER HIDE ANYTHING FROM THE COMPLIANCE DEPARTMENT, BECAUSE THEY WORK WITH YOU, NOT AGAINST YOU.

#compliance #riskmanagement #management #governance #risk #aml #amlcompliance #amlcft #inanutshell #inanutshellbymj